MIDiA has just released its annual recorded music market shares report. Here are some highlights from the report.

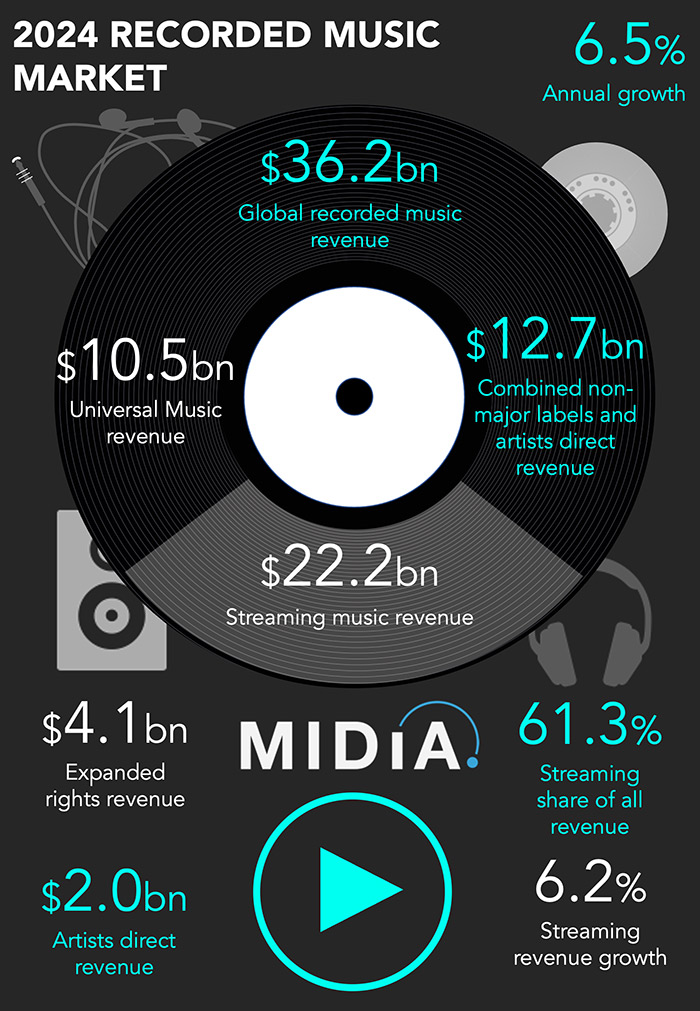

Global recorded music growth has oscillated through the 2020s and 2024 continued that pattern, up 6.5% to $36.2 billion after 9.4% growth in 2023 (excluding expanded rights, the total was $32.1 billion). Given that the first half of the 2020s was characterized by global upheaval and uncertainty, shaped by factors such as the pandemic and rising inflation and interest rates, 6.5% growth was no small achievement. But global disruption is not going away – 2025 has thus far picked up the baton and sprinted with it. The music business is going to have to get used to operating in challenging global circumstances, even before considering a growing catalogue of disruptive industry specific trends such as bifurcation, the rise of the Global South, and a fast-maturing streaming market.

Streaming still dominates revenues, but its impact is lessening. For the first time ever, its share of total revenues declined slightly in 2024, down from 61.5% to 61.3%, with streaming growing slightly slower than the total market to reach $22.2 billion. Streaming is no longer the market maker. Its contribution to total market growth was down by more than a fifth compared to 2022. The streaming revenue slowdown has been on the horizon for many years and – despite price increases – it has now arrived, at least in the West. Not all Western markets slowed to the same degree but some grew below the rate of inflation despite price increases being above the rate of inflation. Super premium cannot come soon enough.

On top of this, physical was down -4.8%, carrying on its very own 2020s yo-yo growth pattern (up, down, up, down). So where did all the growth come from? ‘Other’ – i.e. performance, sync, and expanded rights. Expanded rights (merch, etc.) were up to $4.1 billion, reflecting the recorded music businesses success in monetizing fandom. ‘Other’ as a whole was up 17.3%, while Sony Music pulled up a forest of trees, seeing its ‘other’ revenue up by 38.6% in 2024.

In fact, Sony Music had a good year all round. UMG remained comfortably the world’s largest label with revenues of $10.5 billion but for the second successive year, Sony Music Group (SMG) was the fastest growing major label, increasing revenues by 10.2% to grow market share 700 basis points to 21.7%. SMG was the fastest growing major label in the first half of the decade, growing by a total of 73.9% between 2020 and 2024. The only other market constituent to grow share was non-major labels, up to 29.7% market share. Meanwhile, Artists Direct (self-releasing artists) felt the pinch of new royalty structures, with revenues slower than the market to reach $2.0 billion. This is despite the fact that the number of self-releasing artists grew by 17.2%, with Chinese streaming services Tencent and NetEase seeing particularly strong growth. Streaming revenue is no longer an effective measure of the impact of the long tail.

One of the most important market trends, however, is the growing gap between DSPs and labels and distributors. Streaming services are both growing revenue faster than rightsholders and are widening the growth gap. DSPs grew revenue three times faster than labels in 2024 and the rate of growth was up three years running. Despite working within tightly set rightsholder constraints, DSPs are learning how to improve margin through a diverse mix of tactics including content mix (e.g., podcasts, audiobooks), acquiring cheaper music (e.g., production libraries, exclusive commissions, generative AI), licensing discounts (e.g., audiobook bundles) and charging labels for access to audiences (e.g., Spotify Discovery Mode).

All in all, it was a solid year for the recorded music market, but with warning signs: labels are not keeping pace with DSP growth, and despite keeping the long tail of Artists Direct quiet with new licensing structures, more artists than ever are choosing to release without labels. Eventually they (and smaller indie labels) will take heed of the ‘you are not welcome here’ sign on streaming’s door and build their audiences elsewhere. This will be a short-term win for bigger labels, but long-term risk, with this new lane being where much of tomorrow’s culture will be made. In case you forgot, Bifurcation is coming.