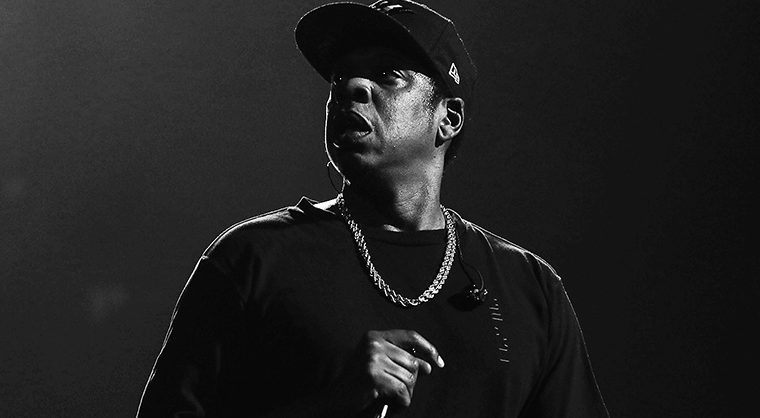

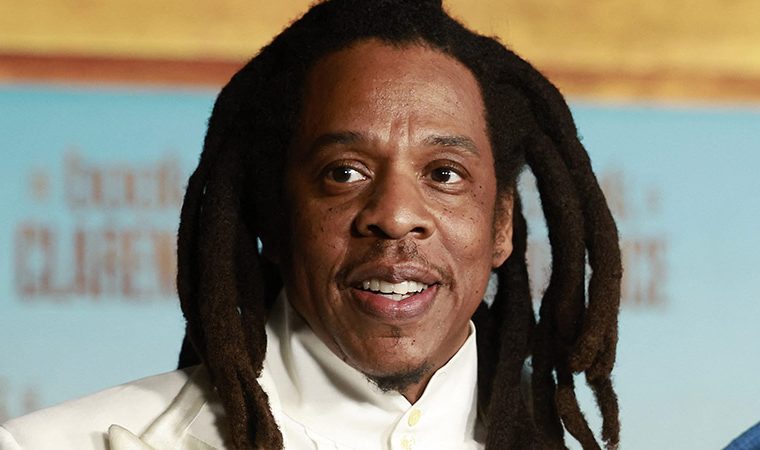

On Wednesday, Jay-Z hosted another milestone performance, looking far from flashy dressed in a suit and stuffed into a nondescript meeting room.

Jay-Z’s Roc Nation company is partnering with SL Green and Caesars Entertainment for the Caesars Palace Times Square (CPTS) bid to obtain one of three downstate New York casino licences. Representatives were on hand for the project’s first community advisory committee meeting.

Jay-Z appeared reserved and almost anxious as he spoke, a far cry from his famous Brooklyn braggadocio.

“I’m trying to reserve myself – it’s a very good idea,” Jay-Z said quietly, searching for the right words. “Very good alignment for us to fulfil the promise of Times Square.”

He added that his proposal “is not coming to compete with Broadway”, as local actors’ unions and theatres have contended. Rather, CPTS would be “additive” to the industry, he said. One of his first calls, he noted, was to Disney CEO Bob Iger to work out a solution to keep “The Lion King” musical at the site.

“Anything that we’ve done in the past [at Roc Nation], we always included the community,” Jay-Z said.

Caesars is the biggest-name casino operator among the eight bidders, which really might be seven with the Bally’s proposal all but dead due to zoning issues. Caesars, in its presentation, boasted of 53 properties across North America with more than 50,000 employees. This breadth of destination and regional casinos is noteworthy, as Caesars is pitching CPTS as a mix between the two.

It would be a destination luxury resort, but with bare-bones amenities, meant to drive traffic to local businesses. Instead of a new development, CPTS is a retrofit of an existing office building at 1515 Broadway. With fewer than 1,000 hotel rooms, just four restaurants and no retail space, it is among the smallest-scale projects left in the field. Its central Times Square location, though, is the most recognisable.

“The Caesars brand is reserved only for our flagship luxury properties, which is exactly how we are positioning CPTS,” said Brian Agnew, Caesars senior vice president of corporate finance. He later added that CPTS “will be on par with the quality of a destination like Caesars Palace Las Vegas,” but “in a New York way”.

To help sell the community involvement aspect, Agnew revealed Wednesday that Caesars will expand its rewards programme so that members can redeem points at local businesses, an industry first.

“We are creating an ecosystem where all businesses in Times Square become part of this project,” Agnew said. “We just provide the gaming in a converted office building and all of our neighbouring businesses become our partners.”

In contrast with Caesars’ vast empire, SL Green is a New York specialist. CEO Marc Holliday explained how his company “is all-in on this city like no one else”, as the city’s largest commercial landlord. A holographic map showed all of the company’s Manhattan holdings, like a scene out of a Marvel movie.

“What you don’t see here are any properties in Florida,” Holliday said. “Nothing on the West Coast or in Texas. Nothing in the Southwest. To use some gaming lingo, we do not hedge our bets when it comes to doing business in what I believe to be, in my heart of hearts, the best city in America.”

SL Green is among several prominent non-gaming entities still vying for a New York licence. Others include Silverstein Properties, Soloviev Group and Thor Equities. Another bid spearheaded by Related Companies was withdrawn earlier this year.

For nearly all of them, the casino licensing process represents a unique development opportunity. Casino gaming is an economic driver that can supercharge a project, but it also makes the proposals contingent on that element. Most of the sites chosen for these bids could not be developed to the same scale without gaming included.

Holliday asserted CPTS would “fit like a glove” and become a “contextual” part of Times Square. He also touched on community involvement, saying the property is “specifically designed to share the time of the gaming patron and hotel guest with all the Times Square and New York City has to offer”.

Caesars’ bid represents an interesting conundrum for state officials in deciding exactly what they want from this process. Ostensibly, the three available licences are to be issued in a way that maximises economic impact and tax generation while minimising negative effects.

Under that logic, the speed to market and substantial tax revenue from existing racinos MGM Empire City and Resorts World NYC make them likely frontrunners. That would leave just one licence remaining, and there are three bids from Manhattan alone, including CPTS. As the dominant borough from a wealth and tourism perspective, the idea of excluding Manhattan seems suboptimal.

Yet even the range of Manhattan bids raises questions as to preferred criteria. CPTS would be relatively quick to market, but is the smallest scale in terms of amenities and non-gaming offerings. Freedom Plaza and Avenir would be bigger and more inclusive, but would take longer to produce. Non-Manhattan bids such as Steve Cohen’s Metropolitan Plaza in Queens would be more of a traditional, standalone destination resort rather than another feature of the cityscape.

CACs have until 30 September to issue votes based on public support of each project. Each bid must receive a two-thirds majority approval to move on to the next phase. The New York State Gaming Commission will issue up to three licences by year’s end. S: IGB